Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowAn Indiana federal court that for a dozen years was presided over by the same four judges has undergone a near-total overhaul in the past two years.

Coachys

Coachys“It’s a little unusual our court turned over so many faces,” said James Coachys, former chief judge of the United States Bankruptcy Court for the Southern District of Indiana, who retired Sept. 30.

Coachys was a rookie on the bench in 2000 when he was appointed to a 14-year term. He joined Judges Basil Lorch III, Anthony Metz and Frank Otte on the court, a foursome that stayed unchanged until Metz retired in October 2012. Otte retires Dec. 31, leaving Lorch as the only judge with more than a couple of years of experience on the Bankruptcy bench.

No vacancy

Moberly

MoberlyDespite these departures, there are no appointments to be made and no judgeships up for grabs. That’s come as a surprise even to some well-informed lawyers who practice in the court, said Chief Judge Robyn Moberly.

“I’ve had a couple of people ask me when they’re posting the job, and of course it was posted two years ago,” Moberly said of Coachys’ position. Moberly was appointed to fill the vacancy created when Metz retired. Judge James Carr was appointed a few months later, filling the vacancy created by Otte’s retirement. Judge Jeffrey J. Graham was appointed in September as Coachys’ replacement.

Otte technically retired, but he had been serving on recall status approved by the Judicial Conference of the 7th Circuit, the Bankruptcy Court’s equivalent to a senior judge. Moberly said the court has been fortunate to have Otte’s service, because for years he qualified to receive a full-salary pension of $183,172 a year for life, whether or not he heard cases.

“I certainly enjoyed what I’ve been doing and I’m very fortunate to have had the opportunity,” said Otte, 76. “I like the work, and the fact that I could have retired at 65, 11 years ago, doesn’t phase me a bit. … It was the taxpayers that funded this operation, and I never wanted to forget that,” he said.

Federal law provides Bankruptcy judges full-salary annual annuities upon retirement if they have reached age 65 and completed a 14-year term. Retired judges may not practice law in any manner and continue to collect the pension, but many judges opt to continue hearing cases after they qualify for retirement benefits if their terms continue or if recall status is available.

Coachys, 65, who retired at the end of his term, and Otte, who served 28 years on the Bankruptcy Court, have chosen not to hear cases.

Lorch has reached retirement age and is eligible for a pension, but he doesn’t plan to go anywhere for a few years. The 7th Circuit encourages judges to provide notice of retirement at least a year in advance, and Lorch said people have asked him about his intentions. “My present appointment runs several more years, I still enjoy it, and I plan to continue to do it for a while longer,” he said.

Like Coachys and Otte, Lorch said the long duration of the court that also included Metz produced a dynamic beyond collegiality, resulting in lasting friendships. “I don’t know if we ever had a disagreement among us,” he said. “We always reached consensus about how we were going to run the court.”

While Lorch will continue to hear cases, he expects to reduce and perhaps eliminate his docket in Indianapolis. He’ll operate primarily in the courts for the Evansville and New Albany divisions. “It’s exciting and different for me to have all new colleagues. I’ll miss the old ones, but I enjoy the new ones,” he said.

Learning curve

Coachys praised the diversity of experience of the newest judges: Moberly, Carr and Graham. Moberly said that diversity has been beneficial for the new colleagues.

“Any new job has a learning curve, and the learning curve is really energizing, I think,” she said. Being the only new judge with a judicial background, Moberly can draw on her experience as a Marion Superior Court judge to share bench tips with Carr and Graham. She benefits from their extensive backgrounds as bankruptcy litigators. “That’s helpful if I need clarification” on points of bankruptcy law, she said, “and I’ve tried to be helpful with issues of how to judge, case manage and deal with lawyers.”

Moberly and other new and retiring judges also praised court staff. Several said it’s a tribute that new judges largely kept intact the staffs of their predecessors. “They’re not only experienced, but they’re enthusiastic and they really have a lot of internal knowledge about how the court works,” she said.

Graham said he feels privileged now being on the other side of the bench, applying the law rather than arguing on a client’s behalf. But he also knows there’s a challenge for the new court. “The scary thing is just how much experience we’ve lost from the bench in the last couple of years,” he said. “It’ll be different as (litigants) learn the way (newer jurists) judge and see things.”

Graham said he feels privileged now being on the other side of the bench, applying the law rather than arguing on a client’s behalf. But he also knows there’s a challenge for the new court. “The scary thing is just how much experience we’ve lost from the bench in the last couple of years,” he said. “It’ll be different as (litigants) learn the way (newer jurists) judge and see things.”

Graham had been a partner at Taft Stettinius & Hollister LLP before being appointed to the court in September. His investiture ceremony is tentatively planned for sometime in April 2015.

Coachys said the new judges’ backgrounds are complementary. Graham, he said, is “much, much younger than everybody else, but he’s very, very bright.” Carr, who came to the bench after 35 years at Faegre Baker Daniels LLP, was “one of the top Chapter 11 lawyers in the state,” Coachys said, and Moberly “will do a great job as chief. She’s really sharp and she knows people well.”

Cases decline

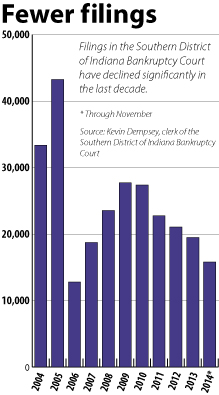

Signs of an improved regional economy can be seen in data from the Bankruptcy Court. Case filings for 2014 continue a downward trend of recent years. Filings are on track to be the lowest in almost a decade and less than half the number from 10 years earlier.

“We kind of expect it to continue that way,” Moberly said of the decrease in filings. Lorch said that makes it unlikely the court will have a fifth judge as has been the case in recent years with Otte serving on recall status.

“I think number-wise we’ll be fine,” Lorch said, noting the new judges “are all highly motivated and it seems like we’re going to keep going without breaking stride.”

Otte spent the last weeks of December packing boxes and saying farewell to colleagues after 48 years in the law, including 20 years as a private practitioner before his two terms as a Bankruptcy judge. After almost half a century, though, some habits die hard.

“I’m going to have an office downtown,” Otte said, though he hasn’t decided precisely where it will be or even exactly what he’ll do when he gets there. “I’m just going to have a place to go,” he said. “It’s just kind of hard to change after 48 years.”

Like Coachys, he’s looking forward to actually reading for pleasure, spending time with family, and traveling. He’s also optimistic the court will be in good hands.

“I do think the new judges who’ve been appointed will be really good and carry on the tradition of the court,” Otte said. “I would say that change is the only constant in life, and the only thing that doesn’t change is change.”•

Please enable JavaScript to view this content.