Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowSending seasonal gift baskets or holiday cookies could be considered an ethical violation for lawyers who might want to say thanks to a colleague in the legal profession for sending a client their way.

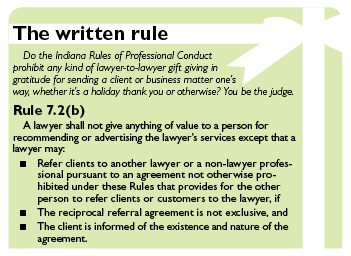

That’s the takeaway from a strict reading of Indiana’s attorney advertising rules, which were rewritten a year ago and are now in place for their inaugural holiday season. One revision broadens the scope of a rule on the “channeling of professional work,” leaving lawyers with little practical guidance on what the line is on sending holiday tokens of appreciation to those who’ve helped their practices in the past.

But those enforcing the disciplinary rules, along with attorney ethics experts and an array of small and large law firm practitioners, say they don’t think nominal holiday gifts rise to the level of an ethical rule violation. Instead, it’s the large-scale gifts and back-room referral patterns that are the focus of the lawyer conduct rules.

“I will be surprised if any sensible attorneys change their practice of sending cards that could not be compensation or anything of value within the meaning of the rule,” said Jerry Jenkins, a partner at Baker & Daniels in Indianapolis who leads the firm’s ethics committee. “The Supreme Court surely has more important things to do than pursue holiday baskets and such.”

Changes to the Indiana attorney advertising rules in 2010 shuffled existing provisions and revised some of the writing of the professional conduct rules. For the most part, it did not change the essence of the provision, but in some places, it did broaden the scope. The court changed two sections that deal with attorney referrals in the context of advertising. Previously, Rule 7.2(b) had focused on press, radio, television or other communication mediums, but those listed areas were removed from the 2011 version. Now, it just prohibits lawyers from giving “anything of value to a person for recommending or advertising the lawyer’s services.” That’s led some to question whether the provision prohibits any referral-related holiday giving between attorneys that might have even the slightest value.

Commentary added for the first time to this rule specifically says the rule in question is designed to prohibit a lawyer from paying others for “channeling professional work.” That phrase is new and remains open for interpretation, according to the Indiana Supreme Court Disciplinary Commission executive secretary G. Michael Witte.

At the moment, Indiana doesn’t have any law on the books about that specific issue and the court hasn’t issued any guidance on what is and isn’t allowed, he said. But Witte doesn’t see the rule’s wording would lead to enforcement for those sending something that would otherwise be determined “reasonable” in most situations.

He looks to the state’s judicial code of conduct, which in Rule 3.13 allows for reasonable gifts that are “commensurate with the occasion.”

“That refers to birthdays and holidays, and while we don’t have anything that refines it more, that provision gives us a reasonable point of reference here,” Witte said. “We know there are certain things that occur during the calendar in the year when lawyers give and receive gifts, and the holidays are one of them where this would be termed appropriate.”

Witte hesitated to define what might cross the line of being “reasonable,” saying that he doesn’t want to define it and – if the case arose to test that line – the Supreme Court would have to offer that interpretation.

Law firms contacted by IL either declined to comment on this issue or offered statements that they comply with the rule as it’s written, without saying whether they specifically read the rule to preclude any small item such as holiday gift cards or baskets.

Limontes

LimontesAlex Limontes, of counsel at Mitchell Hurst Dick & McNelis and incoming chair of the Indianapolis Bar Association’s Solo & Small Firm Committee, reads the rule to be more focused on the continued practice of funneling work to attorneys. The “for” part of the provision is the most important, he said.

“With regards to holiday gifts, I think that you begin to tow that line between ethical and unethical conduct if you give a large gift or significant monetary gift,” he said. “If you send the gift with a card that states something like, ‘Enjoy the gift. Thank you for sending me all of those clients,’ then that could potentially be construed as giving something of value for recommending or advertising.”

Limontes would advise attorneys to try and keep gifts simple and inexpensive such as cookies, candy or gift baskets. Multiple gifts could all be the same so that no one appears to be getting special treatment, and lawyers should avoid putting themselves in positions where someone could question the reason for the gift.

On the referral issue, he and others say that written non-exclusive fee agreements as outlined in Professional Conduct Rule 1.5 should be used between attorneys if any clients are being referred.

At Barnes & Thornburg in Indianapolis, law firm management relies on the counsel of the state’s former attorney ethics chief, Don Lundberg. While he doesn’t think an item like a gift basket falls within the Rule 7.2(b) prohibition, Lundberg does see how a literal reading of the rule can be taken to encompass those items and might cause some attorneys to wonder if this might be a practical concern.

“I suppose an after-the-fact, tangible expression of gratitude could be substantial enough and given in such a way that it would reasonably be viewed as a promise to make a similar gift for future referrals,” he said. “In that event, it could readily be interpreted as a quid pro quo rather than a pure gratuity.”

To avoid any potential issues, Lundberg said lawyers would be well-advised to be transparent about whether something is a gift of appreciation or something more. For example, a note could be written and attached to a box of chocolates or nuts to say, “I hope you’ll accept this as an expression of my appreciation for the business you have referred to me over the past year.”

He cautioned, “If, in reality, it is a disguised quid pro quo for referral of a case and the ‘gift’ is of substantial value and tied to the result in a particular case, no amount of window dressing will keep it from being what it really is.”

Jenkins agreed, saying that although there’s little guidance about what the rule means and no disciplinary decisions interpreting this provision, lawyers should be conservative in how they handle any gift – even during the holiday season.

“As for Christmas baskets and other nominal gifts, the careful attorney will take pains to emphasize that it is a holiday gesture to a business acquaintance and not compensation for a referral of business,” he said.•

Please enable JavaScript to view this content.