Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowWhen the COVID pandemic started in early 2020, most bankruptcy attorneys anticipated that the high unemployment and disruptions to the U.S. economy would result in a spike in bankruptcy filings for consumers unable to make payments on their debts.

Matthew Conrad, a consumer bankruptcy attorney with Conrad Legal LLC in Indianapolis, said the word “tsunami” was thrown around to describe what legal observers thought would be a tidal wave of filings in federal courts.

“Well, the tsunami never arrived,” Conrad said.

Indeed, bankruptcy filings in Indiana’s Northern and Southern Districts fell in 2021 and 2022.

But those filing numbers are starting to finally creep up, with year-over-year increases reported in the Northern and Southern Districts and nationally in June.

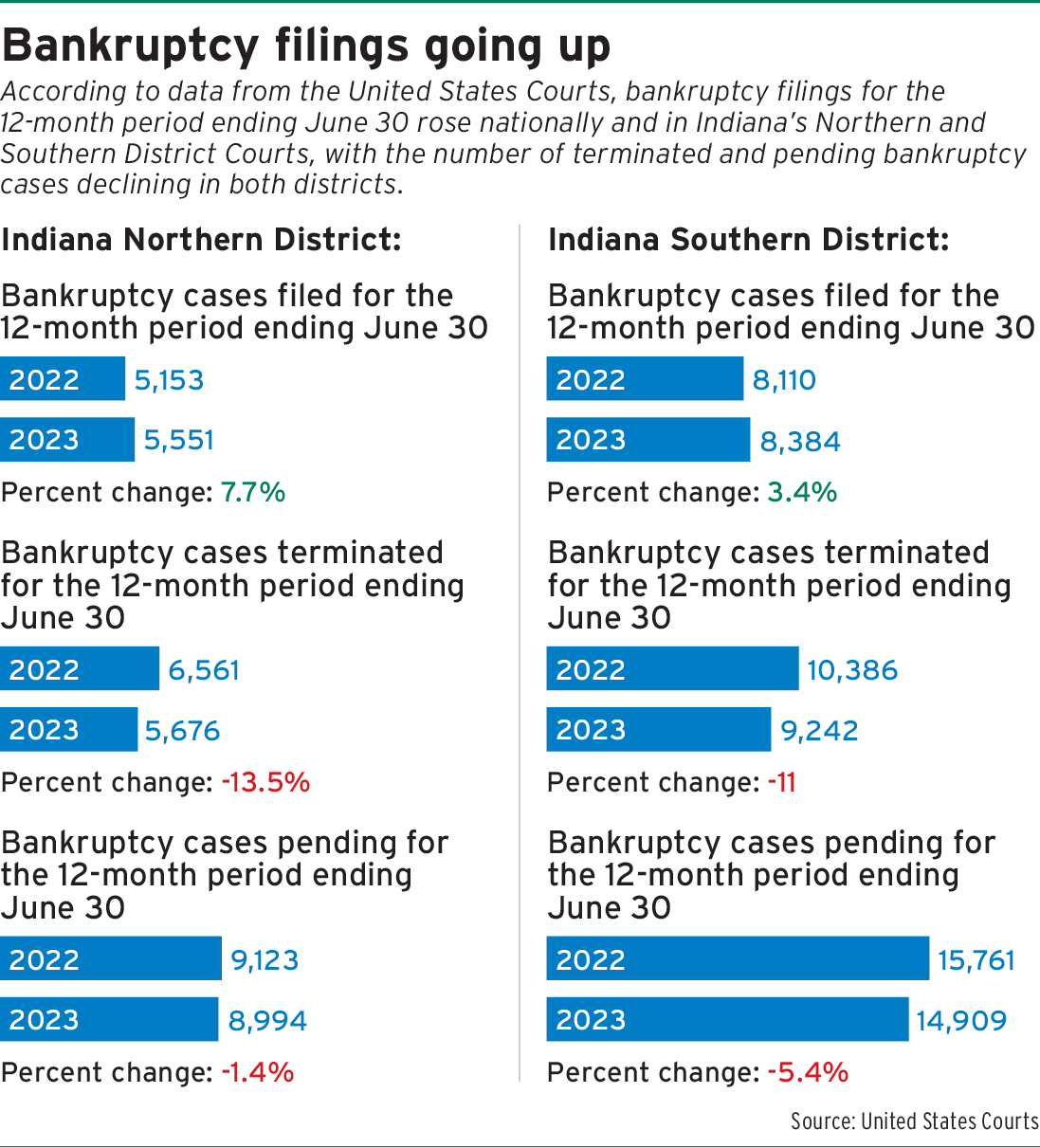

Personal and business bankruptcy filings increased 10% nationally in the 12-month period that ended June 30, according to data from the Administrative Office of the U.S. Courts.

In Indiana, the Northern District saw an increase of 7.7% in filings, and the Southern District had an increase of 3.4%.

Conrad stressed that the total number of bankruptcy filings is still well below normal and significantly trails those numbers he recalled from 2010 and 2011, when the filings hit their most recent peak during the Great Recession.

“But filings are on the way back up right now,” Conrad said.

Why the rise?

In virtually every month of 2023, Conrad said, the filing numbers were higher than they were in the same month in 2022, with the exception of September.

He said he thinks the plunge in bankruptcy filings during the COVID pandemic was fueled by certain factors.

For example, in the early days of the pandemic, creditors backed off on collection efforts, Conrad said. Debtors were also protected by various moratoriums, like those for evictions, and courts postponed nonessential hearings.

Conrad also cited wage garnishment hearings.

“Wage garnishment is a major motivator for people to file for bankruptcy,” he said.

Also, stimulus checks, pauses on federal student loan repayments, Paycheck Protection Program loans and unemployment benefit extensions factored into the drop in bankruptcy filings during the pandemic, Conrad continued.

But repayments on federal student loans are resuming this month after a lengthy moratorium. With that resumption, Conrad and other Indiana bankruptcy attorneys think that may spur additional increases in individual consumer bankruptcy cases.

‘A major stressor’

Corey Benjoya, attorney with the Bankruptcy Law Office of Mark S. Zuckerberg, said his office is definitely seeing an uptick in calls compared to last year, with a higher number of case filings compared to 2022.

Benjoya said the majority of clients that the Zuckerberg firm has are carrying student loan debt.

“I think that has had a big impact on the reasons why they are calling,” he said.

But Eric Lewis, an attorney at Lewis Legal Services in Indianapolis, said he’s not seeing an overall surge in bankruptcy filings at his office.

He described the year-over-year increases reported in June as relatively small and coming on the heels of bankruptcy filings in the Indiana Northern and Southern Districts consistently trending down for the last 10 years.

There were 5,551 bankruptcy filings in the Northern District for the 12-month period ending June 30, 2023. That’s compared to 5,153 for the previous 12-month period ending in June 2022.

In the Southern District, there were 8,384 filings recorded for the period ending June 30, 2023, compared to 8,110 the previous June 30.

Lewis said he’s been handling bankruptcy cases almost exclusively since 2009. One stressor for clients that had not emerged until recently is student loan debt, he acknowledged.

Lewis said he expects there could be more bankruptcy filings when the three-year federal student loan repayment moratorium ends.

“That will be a major stressor that may push people into filing for bankruptcy,” Lewis said, adding that he has encountered very few people in his office for consultations who don’t have student loan debt.

Other factors

Jay Perez, an attorney with Perez & Perez based in Brownsburg with offices also in Indianapolis and Lafayette, said he’s seeing an uptick overall in bankruptcy cases at the firm.

“This year, for new clients, we’ve seen a 20% increase compared to last year,” Perez said.

He started as a bankruptcy attorney in 2007, with he and his wife, Cassandra, starting their own firm in 2013.

Perez said medical debt had been a big issue in the past, as far as a financial issue that has compelled people to file for bankruptcy. Credit card debt and car payments are also prominent issues, he said, and he’s starting to see more mortgage foreclosures. Additionally, the firm’s website includes a tab devoted to student loan debt.

In the firm’s Lafayette office, Perez said he has clients who work for Subaru and are making less money than they used to make because the plant can’t get parts. That means those clients aren’t getting the amount of hours and overtime pay that they had been previously earning.

“They’re seeing it more on the backend now than they were during the pandemic,” Perez said.

Like other attorneys, Perez said bankruptcy filings didn’t skyrocket as he had expected during the pandemic, “But it is coming now.”

Conrad said inflation and an increase in car prices for both new and used automobiles are becoming more prominent factors for bankruptcy filings, as well, with clients struggling with much higher car payments. He said it’s not uncommon to see clients with car payments of $700-$750 a month.

In 2024, Conrad said he expects bankruptcy filings to continue to increase, although he isn’t sure how much.

He said a big question is whether the country slips into another recession. If there is a recession with job losses, that would likely cause filings to go back up.

For his part, Benjoya said he sees a couple reasons for the climbing bankruptcy filing numbers.

One, he said, is interest rates, noting people cannot keep up with the minimum payments on their credit cards.

Also, “We’ve seen a big influx of trucking companies and drivers calling our office,” Benjoya said.

He said he thought the reason for those calls is likely inflation-related, with people in general not buying as much and an overall lessening of consumer demand.

For Lewis, another factor that could result in more bankruptcy filings is an average fixed interest rate that’s risen above 7% for 30-year mortgages. That’s combined with rising rent payments, higher monthly car payments and all-time-high credit card debt and monthly credit card balances.

“There’s going to be a breaking point,” he said.•

Please enable JavaScript to view this content.