Subscriber Benefit

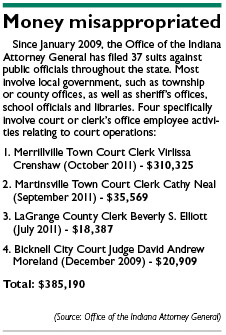

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe Office of the Indiana Attorney General has filed more than three-dozen lawsuits against public officials accused of misappropriating taxpayer money, and local courts and clerks are not immune to those issues.

More claims have been filed since Greg Zoeller took office as compared to previous AG administrations, in part because of a law enacted in 2009. The statutory change has given the state’s top attorney more scrutiny of these situations earlier in the process, allowing for the attorney general to freeze a person’s assets until a final audit report is completed and any legal action is decided. The statutory change also increased the surety bond amounts that local governments carry, meaning that bond can be used to reimburse public funds after a theft or fraud.

Zoeller’s increased attention on public office conduct continues his track record of targeting public corruption and making sure public money is used properly. His efforts have also opened up discussion about how misappropriations are happening in the first place.

“Employee theft and embezzlement is all the more serious when the person is a public servant,” Zoeller said. “Our office zealously pursues those officials who violate the public’s trust to recover for the taxpayers the public funds owed to them.”

Since Zoeller took office in January 2009, he’s filed 37 suits against former public employees to recover more than $1 million. Those suits range from school, police and fire officials to local government officials at county and township offices.

The State Board of Accounts reports that these situations don’t seem to be happening more, but that the new state statute is allowing the AG to file more actions in court to recover money. Often, the audits find local officials don’t keep adequate records. It’s only when the audits show clear evidence that a pattern exists or someone intended to misappropriate money that the AG is brought in to file suit and recover money.

Four cases have been filed as a result of audits showing problems in some small town Indiana courts and clerks’ offices relating to court operations.

The most recent examples came within a week of each other in late September and early October, involving local court operations in Martinsville and Merrillville.

On Sept. 27, Zoeller filed a suit against Cathy Neal, former court clerk of the Martinsville City Court who’s accused of misappropriating $35,569. Neal was responsible for receiving court money such as bond payments and fines, but a state audit found she delayed depositing money for significant lengths of time – on average 62 days. An audit showed the unpaid balance once receipts were reconciled with deposits, and the State Board of Accounts seeks that amount plus $14,265.62 in auditing costs.

On Oct. 4, Zoeller filed a civil suit against former Merrillville Town County Clerk Virlissa Crenshaw to recover funds that had been diverted inappropriately. Crenshaw, as town court clerk, was responsible for collecting bond money, turning it over to the court and keeping records of those amounts. But a State Board of Accounts audit found that for more than five years, Crenshaw appeared to have diverted $310,325 in cash and surety bonds from 456 cases, and some records were entered incorrectly to conceal the loss.

In July, the AG filed a case involving the incumbent LaGrange County Clerk Beverly S. Elliott. According to the state audit, between September and December 2008, the clerk’s office received $6,401 in court fines and fees by credit card, but records show that amount was never deposited into the bank. Another problem found in the state audit involved a trust fund that had been earning interest, and after the trust fund was closed, the clerk overpaid the recipient by $1,600 out of the wrong account. Other bank account shortages were also found, reflecting a total of $18,387 that Elliott owes.

The civil lawsuits against Neal, Crenshaw and Elliott are pending.

Prior to Elliott’s case, the last court-related misappropriation suit was in late 2009 and that was one of the first filed under the state’s revised statute.

Prior to Elliott’s case, the last court-related misappropriation suit was in late 2009 and that was one of the first filed under the state’s revised statute.

Non-attorney Bicknell City Court Judge David Andrew Moreland was the sitting judge at the time he was accused and eventually convicted of theft of nearly $21,000 in court funds. A State Board of Accounts audit found Moreland began pocketing the money when he became a judge in January 2008.

The civil suit accused Moreland of failing to enter motorists’ traffic violation payments into the court’s cash book; that he and his wife wrote themselves checks for personal use from the court-fees account; and Moreland used his sole key to a lockbox to conceal fines that people had paid to the police department when the court office was closed. A total of 93 infractions tickets weren’t entered into the system and that money was misappropriated, the suit said.

Moreland was ultimately removed from the bench and the Knox Circuit lawsuit recovered the money and court costs. He and his wife were also convicted of theft in a separate criminal lawsuit.

While those four cases may seem small in comparison to the 37 total, the AG’s office says they reflect a systematic flaw that must be fixed. Those public offices are supposed to be held more accountable because they’re responsible for administering justice. AG spokesman Bryan Corbin said accurate numbers weren’t kept before Zoeller took office on the amount of public misappropriation cases, but he said the sense from those in the office is that these suits are happening more often because of Zoeller’s continuing effort to combat public corruption statewide.

“This has been a trend only in the sense that misappropriation occurs in various city, county, town and township offices all across the state,” Corbin said. “Regardless of the level of government or geography, what these cases typically have in common is there was insufficient oversight.”

That oversight is a focus for Zoeller during the next legislative session. He’s recommending legislation that would require additional safeguards such as dual signatures on expenditures and involvement by multiple people during the bookkeeping process.

No draft bill has been prepared at this time, according to Corbin, but he said the AG plans to push that effort once the session begins.

“We must do more to protect against breaches of public responsibility and reassure the public that this will not be tolerated,” Zoeller said. “This is why I will be asking the Indiana General Assembly next session to pass a bill that would deter such embezzlements.”•

Please enable JavaScript to view this content.