Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowOf all the topics a couple can discuss prior to their marriage, prenuptial agreements usually haven’t been at the top of the list.

But prenups have become more popular in recent years as people look to protect their assets in the event their marriages don’t work out.

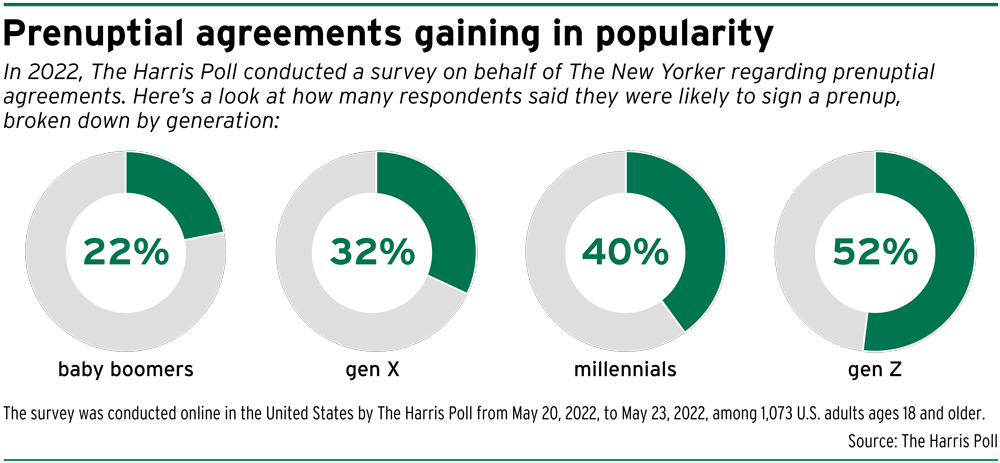

In 2022, The Harris Poll conducted an online survey on behalf of The New Yorker regarding prenuptial agreements, polling more than 1,000 U.S. adults on the pacts.

Of Americans who have been married or were currently engaged, 15% reported that they’ve signed a prenup, up from just 3% in 2010, according to the poll.

Some Indiana attorneys are also seeing a rise in the number of prenuptial agreements they’re drafting at their firms.

James Reed, an attorney at Cross Glazier Reed Burroughs P.C. in Carmel, said prenuptial agreements have become very common, with his firm handling an average of two or three per month.

Reed said the practice is probably most popular with people on their second marriages.

Also, in some cases, he said there’s involvement from parents of children from wealthy families who want their wealth — whether it involve money, land or a business — to stay with their child in the event of a divorce.

Prenups in Indiana

Prenuptial agreements are covered in state law under Indiana Code § 31-11-3, known as the Uniform Premarital Agreement Act. Indiana adopted its version of the Uniform Premarital Agreement in 1995.

Such an agreement must be in writing and signed by both parties voluntarily, and both parties must fully disclose all financial assets and debts.

Rick Kissel, co-chair of the Private Client and Estate Planning practice groups at Taft Stettinius & Hollister LLP, said it used to be unheard of for couples to get a prenuptial agreement ahead of a first marriage.

Although he’s not a family law attorney, Kissel noted a lot of prenups are part of an estate plan, putting them in his wheelhouse.

How long it takes to complete a prenuptial agreement depends on the circumstances involved with the marriage, Kissel explained.

For example, if someone is entering their second or third marriage, or if one of the spouses is giving up a career and will be out of the workforce, it generally makes the agreements more elaborate and time-consuming, he said. But a simpler agreement might take just 10-15 billable hours.

Grace Dillow, a family law attorney at McNeelyLaw LLP, said the prenups her firm is asked to handle usually involve what she described as “high asset marriages.” Like other family law attorneys, she said those cases usually involve people who are getting married for a subsequent time, or who are getting married later in life.

Dillow encourages both parties to have counsel, even if it means it will take a little longer to complete the agreement.

“I really appreciate folks thinking through these problems now rather than doing it on the back end,” she said.

Indiana is unusual in one regard, Reed noted: The state doesn’t recognize the concept of separate property for spouses. Rather, there is a presumption of a 50-50 split of marital property in a divorce, although courts have the discretion to adjust the division of property.

Generational shift

Of the people that responded to the Harris survey, 35% of those who are unmarried said they were likely to sign a prenuptial agreement in the future.

Of the people that responded to the Harris survey, 35% of those who are unmarried said they were likely to sign a prenuptial agreement in the future.

Broken down by generation, 52% of Gen Z survey respondents said they were likely to sign a prenup in the future, as did 40% of millennials, 32% of Gen Xers and 22% of baby boomers.

Reed said he thinks the shift in generational demographics accounts for some of the increasing popularity of prenuptial agreements, with a significant transfer of wealth from older generations to their children.

Kissel said as the Greatest Generation dies off and baby boomers inherit their businesses and farms, they are much more invested in protecting their family assets and encouraging their children to get prenuptial agreements before they get married.

Also, divorce is more common than it was two generations ago, Kissel noted, another factor contributing to the increase in prenuptial agreements.

Some parents are insisting that their children enter into agreements before marriage, Reed added. Those parents will also let their children know that if they don’t have prenups, it will be taken into account when the parents do their estate planning.

“The message is, ‘You do it or there may be consequences,’” he said.

Before the big day

In a perfect world, Reed said, it would be great to have a prenuptial agreement completed before the wedding invitations go out.

It’s always better to consult with an attorney well in advance of a wedding when it comes to prenuptial agreements, Dillow agreed.

Likewise, Kissel acknowledged it’s “not great” if people wait until it’s too close to their wedding day.

For family law attorneys, handling prenuptial agreements usually isn’t difficult, Reed said. He tries to present the agreements in a positive way and put an emphasis on how the contract is a way to preserve family wealth.

He said it’s essential for an attorney that the prenup process is done properly, with a full disclosure of assets and income from both parties and each person having counsel.

Further, in order for prenuptial agreements to be enforceable, each party needs to understand what they’re getting and what they’re giving up.

According to Kissel, Indiana has pretty flexible laws regarding disclosure, although he stressed that “the more disclosure the better,” and that it is a best practice to disclose all assets.

“I tend to overdisclose, and I think it’s becoming more common,” he said.

Attorneys spend a significant amount of time putting together the assets and liabilities of both parties when they draft prenuptial agreements, Kissel said. He recalled one occasion when a client and their soon-to-be spouse completed their agreement at the last minute.

“They literally signed at the rehearsal (dinner) that night,” Kissel said.•

Please enable JavaScript to view this content.