Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowFulton Circuit Judge Christopher Lee can hardly wait to hear the public’s reaction, regardless of whether the comments are good, bad or indifferent.

Lee chairs the Domestic Relations Committee of the Judicial Conference of Indiana, which reviewed and suggested revisions to the Indiana Child Support Rules and Guidelines. The process started with the committee soliciting public input and receiving 425 comments electronically, 20 comments by mail and listening to stories and ideas offered by 21 individuals, including parents and attorneys, who spoke at a hearing last August.

Lee

LeeEvery comment, Lee said, was studied by the committee and helped form the proposed updates. The suggested changes range from supporting prior-born children when no court order exists to inserting statutory language regarding incarcerated parents and clarifying children’s health insurance costs.

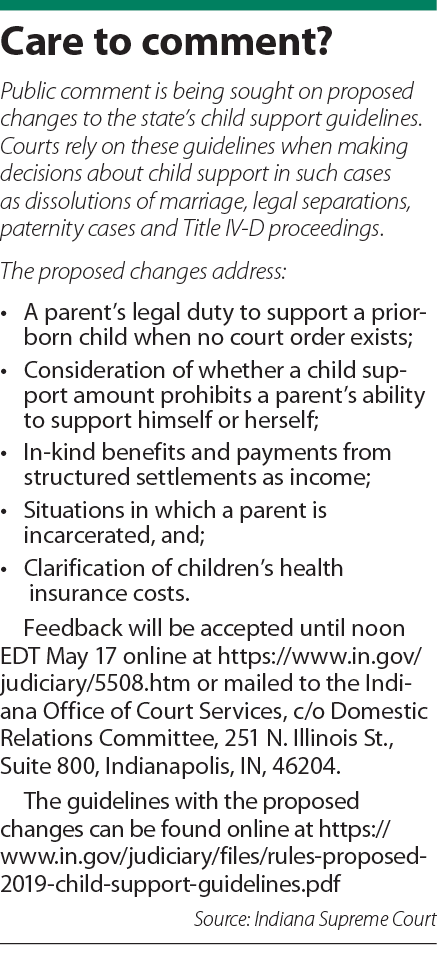

Lee emphasized the process is not complete because the proposed changes were posted April 2 for a new round of public feedback. “I want people to chew it up,” the Fulton County judge said with his Georgia drawl.

Once this round of public comment closes May 17, the committee’s work will begin again. The comments will be reviewed and possibly used to revise the proposed changes. After that, the revamped guidelines will be sent to the Indiana Supreme Court for final consideration.

The child support guidelines are reviewed every four years in accordance with federal law. Attorneys described the most recent proposals as tweaks and adjustments to align the courts with the ongoing evolution of family structures.

Dinn

Dinn“I would not consider it an overhaul,” said Matthew Dinn of Popcheff & Dinn, LLP in Speedway. “They’re always trying to make the guidelines better, and I think this is just one of those tweaks.”

Dinn, echoing other lawyers, said the guidelines are helpful and can bring a resolution to difficult, often emotionally charged, situations. The guidelines provide a framework for calculating child support, and even if the parties do not like the result, many times they will accept it. And for those instances where they do not agree with how the calculation was done, they can take their arguments to court.

“I don’t have a problem with them at all,” Dinn said. “They are successful at what they set out to do.”

Gray areas

Rex Padgett, a divorce attorney in the Indianapolis office of Cordell & Cordell, agreed the suggested changes are “mainly tweaks,” but said they do not level the playing field, especially for fathers. There are huge gray areas, and much is left to the court’s discretion, Padgett said.

In particular, Padgett, whose firm advocates for fathers, pointed to the new language about incarcerated parents. The committee has proposed inserting a sentence reflecting a statute placing some limits on how courts can calculate child support obligations when a parent is in prison.

Currently, child support will continue to accrue, so parents can get released and find out they owe thousands in arrears. This is seen by some as penalizing the individuals a second time, even though they have already served their sentence and are trying to make a fresh start. They can have their wages garnished, lose their driver’s licenses and maybe even feel they have no alternative but to return to a life of crime.

Padgett applauded the proposal that courts should no longer treat incarcerated parents as voluntarily unemployed. “I don’t believe too many people are out there thinking, ‘I’m going to commit a crime so I don’t have to pay child support,’” he said.

But he pointed out that the language says “may” instead of “shall.” Also, the incarcerated parent still must file for a modification of child support. Padgett would like to see something done automatically so individuals are better able to get their support lowered and do not end up with a big overdue notice.

Looking at the new language proposed for determining the amount of child support, Dinn believes the calculations will be more accurate, but pro se litigants will be disadvantaged. Often, he has clients who try to use the court’s worksheet to figure out their child support, and just as often the final figure is incorrect. With some of the changes, the calculations will become more complex, especially for nonlawyers.

Suggested additions to the guidelines would allow the court to consider a parent’s assets, residence, educational attainment, literacy and health, among other factors, when determining potential income. Dinn sees this as an expansion that will help make the support calculations more accurate, but also as something that will keep lawyers and courts active in defining “assets,” “residence” and the other factors.

“This broadening of what the court may consider will really make attorneys earn their keep because it’s not perfectly clear so (the parties) will still have to make an argument if something should be included or not included,” Dinn said.

Prior-born children

Paul Leonard Jr., partner at Burke Costanza & Carberry in Merrillville, characterized the proposed changes as the Judicial Conference attempting to provide some clarity to issues courts and practitioners have been seeing.

For example, judges and lawyers have long been wrestling over how to treat parents who pay child support but have no formal agreement, Leonard said. The stigma of having a baby out of wedlock is gone, as many people are waiting to get married but not waiting to have children. Parents may be comfortable with an informal agreement of who pays for what until one does get married and goes to court to get an order for child support.

The proposals enable the courts to consider consistent payments made to prior-born children when determining child support. Leonard said the changes will give more flexibility to the courts in dealing with different family structures.

“We can look at the totality of circumstances,” he said. “I think it’s a good move.”

From Lee’s perspective, the most significant proposed revision concerns calculating the legal duty for a prior-born child or children where no court order exists. Overall, the proposal establishes a method for calculating the legal duty for prior-born children when no court order exists.

Lee described the change as it would apply to a hypothetical situation based on a scenario that often plays out in his court. A mother has a new baby and is trying to get child support from the baby’s father, but she is also caring for her 10-year-old who has a different father. The whereabouts and income of the 10-year-old’s father are unknown.

At present, the courts have no way to uniformly calculate the financial credit the mother should receive for the 10-year-old, and the legal duty credit for a prior-born child is rarely utilized. Under the proposal, the judge would input her weekly income into the child support tables and then use the weekly support obligation as the credit to be deducted from her gross income. The newly adjusted gross income would be the basis for determining the amount of child support she should receive for her new baby.

“I’m really looking forward to getting feedback on this provision,” Lee said. “I will be interested to see if this is accepted or roundly criticized, if people think this is a fair way to look at that situation or if people have different way to handle this situation.”•

Please enable JavaScript to view this content.