Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe answer to the question of whether lawyers have an obligation to advise their clients on the different settlement structures available to them seemed obvious to attorney Paul Kruse.

“What do you think?” Kruse, an injury attorney at Parr Richey Frandsen Patterson Kruse in Indianapolis, said playfully.

But the question of how much obligation an attorney has to nudge clients toward a settlement type that makes the most financial sense is a trickier question. If a case settles and a structured payment plan is clearly the way to go, what’s a lawyer to do when the client decides that actually, they want the money up front?

“It’s their money,” Kruse said. “… All I can do is bring it to their attention.”

Often, the debate about whether a structured or lump-sum settlement makes sense comes to down to the dollar amount and tax implications.

Generally, money awarded in a personal injury case isn’t taxable, while money awarded in an employment case is.

Where the money is subject to taxes, Merrillville-based employment attorney James Daugherty said one of the questions for the plaintiff is whether they want to take a tax hit all at once, or if they want to spread out their tax burden over the course of several years — potentially the rest of their life.

Daugherty, who chairs the Lake County Bar Association’s Employment Law Section, said the first thing an attorney should do when such a situation comes up is talk to the opposing counsel and see if there’s any interest in doing a structured settlement.

If they’re interested, he said, that’s when an attorney has an obligation to go back to their client and discuss the pros and cons of the arrangement.

“Sometimes it’s a compromise that can be reached between the parties,” Daugherty said.

A ‘cautionary’ approach

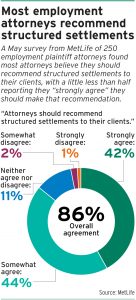

MetLife surveyed 250 employment plaintiff attorneys in May and found that 86% agree they should recommend structured settlements to their clients. About half of the attorneys in that category said they “strongly” agree with the recommendation.

About 3% said they disagree, and 11% said they neither agree nor disagree.

“We feel very strongly about the benefits of structured settlements,” said Bejan Shirvani, vice president and head of structured settlements at MetLife, which manages annuities.

A possible exception to that endorsement, Shirvani said, is an injury case where the settlement amount isn’t large and the person has significant cash needs to take care of — such as medical bills.

“You want to look at it holistically,” he said.

Another finding from the MetLife survey: Almost half of the attorneys said they always encourage clients to meet with a tax attorney and/or financial adviser.

Bruce Kehoe, a personal injury attorney at Wilson Kehoe Winingham in Indianapolis, said he tells clients a structured settlement can be considered as a safe investment tool because an annuity will earn some interest.

A structured settlement can also be preferable when weighing the cost of a potential professional money manager to take care of a lump-sum amount, Kehoe said, especially if that amount is relatively small. And not everyone will opt to have their money professionally managed in the first place.

“I would say every case has to be evaluated on its own,” he said. “I think it’s incumbent upon plaintiffs’ counsel to provide their clients with some guidance, but we’re also cautionary that we do not provide financial advice.”

In the end, cases are unique, Kehoe added, which means a structured settlement isn’t always preferable.

A negotiating advantage

The MetLife survey also polled lawyers on the effectiveness of structured settlements in negotiation, with 86% agreeing it’s a good tool to have.

Daugherty, the Merrillville attorney who also serves on the Employment, Labor & Benefits Law Section Council of the Indiana State Bar Association, said he works on both the defense and plaintiff sides of employment law.

Daugherty, the Merrillville attorney who also serves on the Employment, Labor & Benefits Law Section Council of the Indiana State Bar Association, said he works on both the defense and plaintiff sides of employment law.

A structured settlement can be a good negotiating tool after judgment, he said.

One example is if the plaintiff is facing an appeal and has a feeling that their case may not be strong enough to survive. In that situation, Daugherty said, there could be an incentive to settle.

From the defense side, Daugherty said a settlement can be presented as a compromise instead of going through the appeal process, delaying payment and potentially having the case overturned anyway. So, instead of paying the full amount of a verdict award and attorney fees on top of that, the defense may be able to negotiate a structured settlement in a lower amount.

Back on the rise

A report from Independent Life at the end of 2022 found at that point in the year, structured settlement production during the first three quarters of the year was $3.95 billion, topping the 2021 total through the same time period by about $870 million.

Structured settlement production hit a low of $4.2 billion for all quarters in 2021, the report shows, which followed a previous low of $4.9 billion in 2020. Those were the first two years below $5 billion since 2012.

The upswing was likely fueled by a combination of an increase in what were low interest rates and pandemic-related court closures coming to an end.

If he would’ve been asked two years ago, when the rate of return on annuity contracts was in the 2% range, Kehoe said he would’ve said the firm wasn’t typically incorporating structured settlements.

But the rate of return is higher now — in the mid-4% range, Kehoe said — so a structured settlement makes more sense today than it did just a couple years ago.

“It’s just not a one-size-fits-all consideration,” he said.•

Please enable JavaScript to view this content.