Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe challenge awaiting Justin McAdam as he prepares to take over as judge of the Indiana Tax Court is a unique one in the state’s judicial system.

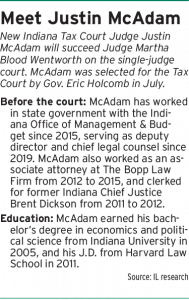

He’ll be an appellate judge and a trial court judge — both for the first time in his career. He’ll also become an authority in the niche legal corner that is tax law. And McAdam, who’s been in state government with the Indiana Office of Management & Budget for the last eight years, will do that from perhaps the loneliest bench in the state, given that the Tax Court is a one-judge shop.

Still, McAdam said he knows he won’t need to go at it by himself.

“You don’t do it alone,” he said July 11 after Gov. Eric Holcomb announced him as the next Tax Court judge. “You have to rely on those that came before you.”

That includes retiring Judge Martha Blood Wentworth, who sat almost directly in front of McAdam as he talked from the podium in Holcomb’s office.

Wentworth became Tax Court judge in 2011, taking over for the only other judge in the court’s history, Thomas G. Fisher, who served as senior judge until 2020. Wentworth said she will also continue to serve as senior judge and help McAdam transition into the role.

McAdam said he’s glad to have Wentworth around. During his remarks, he described her reputation as an expert in the tax field as “unparalleled.”

“I just ask that you give me a little bit of time,” he said with a smile. “It’s going to take me a while to reach your level, but I’m eager to get started.”

The road to Tax Court

McAdam’s wife, Amy McAdam, said after the announcement that her husband will make a good judge because he’s patient and discerning.

The two of them have been together since she was 15, Amy said, and she’s seen him grow through college, law school and his career. They have four children: a 4-year-old, 7-year-old and 11-year-old twins.

“He’s beyond amazing,” Amy said.

McAdam has served as deputy director and chief legal counsel at the Office of Management & Budget since 2019. He’s also trustee of the Next Level Fund Investment Board and chairs the Indiana Board for Depositories.

Holcomb said he knows McAdam is prepared to be the next Tax Court judge.

“Having known Justin for years and years and years,” he said, “I’ve seen up close and personal on a day-in, day-out basis his level-headedness, his calm demeanor, his pursuit to not just serve Hoosiers, but to make their lives better.”

McAdam received a bachelor’s degree in economics and political science from Indiana University in Bloomington, then went on to Harvard Law School, graduating with his J.D. in 2011.

Following law school, McAdam clerked for former Indiana Chief Justice Brent Dickson, who was at the announcement.

“He was thoughtful, studious and extremely confident,” Dickson said of his former clerk. “His work in doing legal research and even drafting initial opinions rarely needed very much modification at all.”

Dickson also said McAdam had a good grasp of the issues and was “extremely fair.”

“Watching him develop and put his talents to use has been a joy to me,” he said. “As a father to a surrogate son, so to speak, it was a real joy.”

McAdam also worked as an associate attorney at The Bopp Law Firm in Terre Haute from 2012 to 2015 before joining the Office of Management & Budget.

Outside the legal field, McAdam has served on the board of the Avon Education Fund.

Goals for the court

McAdam, like others who applied and interviewed for the vacancy in May, talked about a need to make the Tax Court move more efficiently. After being appointed, he said he needs to get into the court and make an assessment of how exactly to do that. That process will include talking to practitioners and others.

McAdam, like others who applied and interviewed for the vacancy in May, talked about a need to make the Tax Court move more efficiently. After being appointed, he said he needs to get into the court and make an assessment of how exactly to do that. That process will include talking to practitioners and others.

When he interviewed for the position, McAdam said he believed 90 days was a reasonable amount of time, on average, to issue opinions. Speaking after the announcement, he said he still believes that’s the right benchmark to aim for, with the caveat that more complicated cases could take longer.

If anyone is familiar with the challenges ahead for McAdam, it’s Wentworth, who said one of the most difficult things about the single-judge court is a feeling of isolation.

“I don’t have a colleague,” she said, referencing the complexities of tax law. “So the way I deal with it is I broaden my wings.”

McAdam, she said, will have to learn where good help comes from, in part because tax law isn’t on the state bar exam anymore, so lots of students leave law school without that knowledge. That means McAdam will have to be “the biggest cheerleader in the state for tax law,” she said.

And that’s on top of learning the “nuts and bolts” of taxes, Wentworth added.

“He’s going to have to learn how to navigate all that,” she said, “and I hope I can help him by introducing him to various organizations and people.”

For McAdam, he said he’s aspired to be a member of the bench since clerking for Dickson — which he called “one of the best experiences I’ve had.”

“And I’m looking forward to that opportunity,” he said, “to take what I think are many of my strengths and really put them to work here serving the people of Indiana by delivering fair and impartial decisions.”•

Please enable JavaScript to view this content.