Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowEven though asset values and wealth are being squeezed in today’s economic environment of inflation, rising interest rates and possible recession, estate planning attorneys are looking beyond the current market conditions to the calendar.

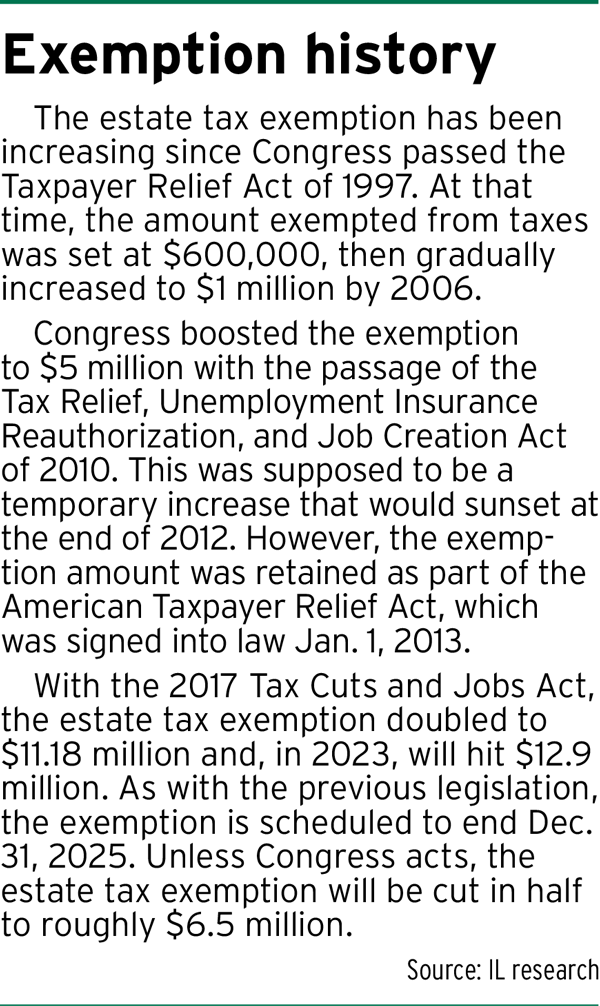

An estate tax exemption that has doubled to more than $12 million per individual as part of the Tax Cuts and Jobs Act of 2017 is scheduled to get sliced in half at the end of 2025. Individuals and couples who have assets exceeding the exemption are avoiding the looming tax increase by transferring their wealth through gifts to their children and grandchildren.

The wild card in this situation is Capitol Hill. Congress could tinker with the exemption provision, either extending the sunset or, maybe, making an even steeper reduction. Estate planning attorneys are advising their clients to plan as if the exemption will revert back to $6 million on Jan. 1, 2026.

“We don’t know what they’re going to do but we know what’s going to happen if they do nothing,” Greg Duncan, partner at Dentons Bingham Greenebaum, said. “Lately, Congress has done nothing.”

Attorneys acknowledge households with enough money to qualify for the exemption are not facing financial ruin if the exemption expires. Yet they are having to educate, counsel and exercise patience as clients decide what to do and when.

Those decisions vary. Some are determining who will receive the gifts while others with assets in the $15 million-$20 million range are thinking carefully about the amount they can comfortably gift and still maintain their lifestyles. Conversely, many whose assets are invested in their small businesses are selling despite the value of their companies being lower because of the drop in the market.

“So there’s a lot of things going through people’s mind,” Duncan said. “But I think overall, for those who have the wherewithal, gifting is taking place at a ferocious rate really starting last year and this year. There have been a lot of generational transfers of wealth down to children and grandchildren.”

Opportunity is now

John Olivieri, partner at Barnes & Thornburg, admitted he was a little confused when the financial adviser to a client with a net worth below the exemption level was pushing to gift some of the assets.

The attorney suggested the client could afford to take the time to watch and see what happens before making a move. However, the adviser explained the current “bad time in the market” is decreasing the value of the assets, so the client could transfer more. The value will eventually increase, benefiting the recipients, when the market swings upward.

The convergence of today’s economy and the possible future loss of the exemption is spurring activity.

“I haven’t yet come across anyone who says, ‘Oh my gosh, I might not be able to buy eggs and milk because my portfolio is down to $8 million,’” Olivieri said. “I’m not getting that, but I am getting, ‘OK, this is an anomaly, the sharp downturns in the market, what can we do with that?’ When you combine that with a potential loss of exemption, a number of people are saying, ‘Now is the time to do things because if we wait until 2025, maybe the market will be back up.’”

At Dinsmore & Shohl, partner Kent Broach is also not receiving any panicked calls from clients, but their uncertainty is prompting him to draft flexibility into estate planning documents.

Clients see the opportunity of gifting now when asset values are “just getting beaten down,” Broach said. In time, the economy will reverse and the value will grow, so transferring the wealth will remove that appreciation from their taxable estates.

Broach educates his clients about the different financial tools available and how those tools work, sometimes keeping flowcharts handy as visual aids. He is having conversations and counseling them, but when the estate papers are ready to be signed, they are hesitating.

“A lot of times, I’ll meet with clients and we’ll go through some planning options and then they just won’t do anything,” Broach said. “It’s easy to hide from this and not want to think about it. It happens quite often.”

Inaction on the Hill

Congress has given no indication of what it will do, although a bipartisan plan seems unimaginable. House Democrats were discussing in 2021 the possibility of reducing the exemption even further to $5 million, while Republicans have long pushed for eliminating the estate tax altogether.

Another factor that may play into discussions about extending the sunset is government spending. Duncan pointed out the exemption is diverting tax revenue from federal coffers at a time when Capitol Hill has doled out money to sustain families during the worst of the COVID-19 pandemic.

Consequently, getting “Congress to be very sympathetic for” a small group of wealthy people who are benefiting from the higher exemption may be difficult when the national debt is raising concerns, he said.

Consequently, getting “Congress to be very sympathetic for” a small group of wealthy people who are benefiting from the higher exemption may be difficult when the national debt is raising concerns, he said.

The Center on Budget and Policy Priorities criticized the 2017 law for its limited impact. Namely, the CBPP faulted the exemption for benefiting the wealthiest, costing $1.9 trillion in lost revenue and expanding opportunities for “wealthy people to game the tax system.”

Calling the loss of tax revenue “irresponsible,” the organization highlighted the coming fiscal challenges. The country will need financial resources to address an aging population, health care costs, interest rates returning to more normal levels, and national security as well as infrastructure needs.

Broach countered that in the case of small businesses, the exemption can boost more than the owners. He gave the example of parents passing their company to their children who then are able to grow and expand the operation.

“As the company just clicks along, it’s good for the economy, it’s good for the employees, it’s good for the family,” Broach said.

Cost of business

Dan Rosio, partner-in-charge of Katz Sapper & Miller’s Valuation Services Group, said he is only sure that any action on the exemption by Congress will come later rather than sooner.

“It’s hard to predict anything,” Rosio said. “You can’t predict what Congress is going to do, but my main prediction is they usually do nothing until the very last minute.”

The people who are not waiting are the baby boomers who have their wealth in their businesses and no heirs wanting to take over. They hung on to their companies through the Great Recession and have continued to unlock the doors and turn on the lights every day since.

But Rosio said he is seeing owners in all sectors, from trucking and construction to real estate and health care, who realize the market has diminished the value of their businesses but are still selling. That has created a hot transaction market that Rosio said he is not expecting to cool.

The business owners are taking advantage of private equity money to sell before the exemption expires and the top tax rate jumps to 39.6%. Yet, the main reason for retiring is fatigue.

“When the clients call me for valuation work, the ones that want to sell, they basically tell me, ‘We are just tired of doing this,’” Rosio said. “… Not only have they run the business, but they’ve just had to survive this last 2½ years of just complete chaos. And the clients are calling me and saying, ‘We’re just done. We just want to sell it and be done.’”

Looking at his calendar, Olivieri said he is anticipating December 2025 will be very busy as people try to outrun the sunset. He is trying to avoid a rush by counseling his clients to transfer now.

“If you make a big gift before the exemption goes away and it turns out it doesn’t go away and it ended up with your children where you wanted it anyway, there’s no harm, no foul,” he explained. “But if you don’t give it away, then you could really be hurt.”•

Please enable JavaScript to view this content.