Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowFor some estate law attorneys who handle planning for wealthier clients, Dec. 31, 2025, is circled on their calendars.

It’s still almost two years away, but it’s the last day before a key estate tax provision of the federal Tax Cuts and Jobs Act is scheduled to expire, barring congressional action to extend the law or pass new legislation.

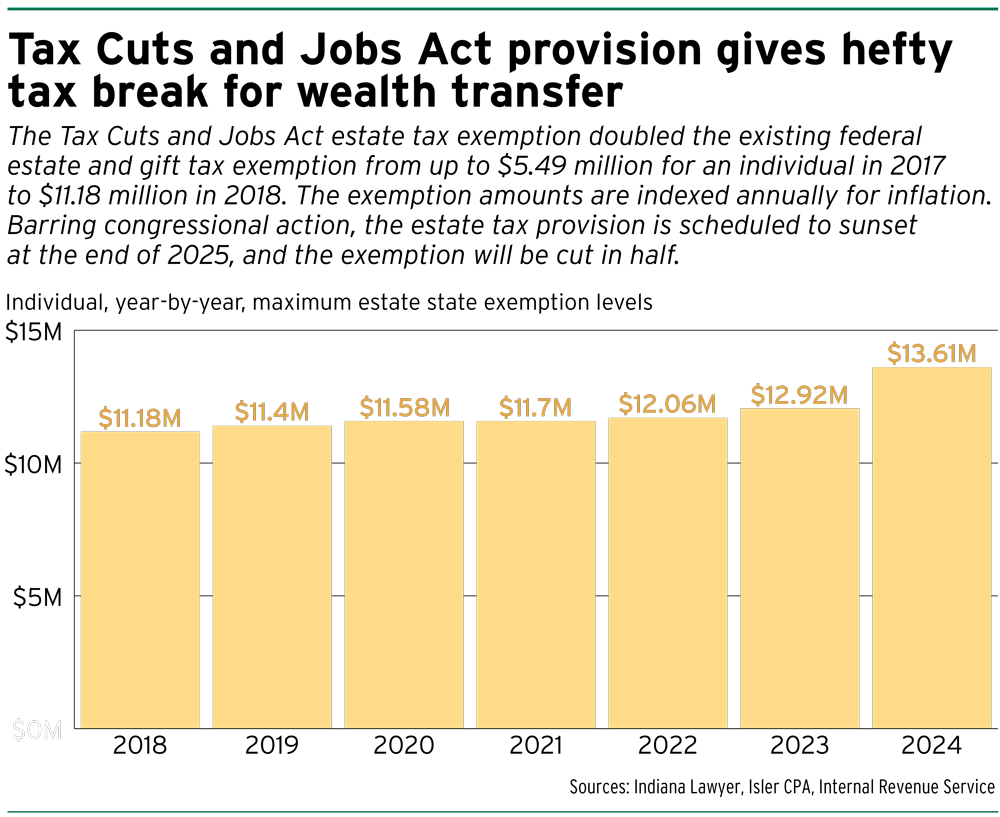

The TC&JA, which passed in 2017, temporarily doubled the estate-tax exemption amounts starting in 2018. In 2024, individuals can transfer up to $13.61 million with the threshold for married couples set at $27.22 million.

Since the exemption is adjusted annually for inflation, those numbers are substantially up from 2023, when the threshold stood at $12.92 million for individuals and $25.84 million for married couples.

But unless Congress makes the change permanent, the estate tax exemption will “sunset” on Jan. 1, 2026, and the exemption amounts will revert to 2017 levels, adjusted for inflation.

Greg Shelley —a partner with Bose McKinney & Evans LLP’s Business Services Group and chair of the firm’s Estate and Wealth Transfer Planning Group — said the firm gets a lot of calls from clients who want to take advantage of the exemption or just learn more about it.

“In my experience, even wealthy clients, like the rest of us, are reluctant to give away large sums of money,” Shelley said. “They want to take advantage of the exemption, but they don’t want to give up control of their wealth.”

Kent Broach, a partner in Dinsmore & Stohl LLP’s Indianapolis office, said a lot of his clients are what he would describe as “self-made.”

Like Shelley, Broach said it is often hard for clients to let go of their wealth. He said he’s drafted documents for some clients who are taking a wait-and-see approach before they commit to making wealth or asset transfers. Most of those clients are retired, he noted.

Business owners can also take advantage of the exemption, Broach added, and can gift pieces of their businesses to family members.

Using SLATs

Shelley said one planning technique used by married couples with the exemption is a Spousal Lifetime Access Trust, an irrevocable trust that allows one spouse, known as the donor spouse, to gift assets to a trust to benefit the other spouse — and possibly additional family members — and remove the assets from their combined estates.

“As long as they’re married, they can enjoy the income from the gifted assets,” Shelley said.

But there are potential risks with SLATs, he added, such as if a couple divorces and one spouse was a designated beneficiary and can still get the benefits of the trust’s assets.

Shelley said he drafts SLAT documents so that, if there is a divorce, the spousal access to the trust ends when the marriage ends.

Broach said SLATs are the most popular planning tool for people wanting to use the estate tax exemption. Moving assets from the estate into the SLAT reduces the size of the estate while also giving the couple continued access to their assets, he explained.

Growing interest

Broach said the most interest among clients he could recall regarding estate tax issues may have happened in 2010, when, because of congressional inaction, the estate tax lapsed for a year.

Broach said the most interest among clients he could recall regarding estate tax issues may have happened in 2010, when, because of congressional inaction, the estate tax lapsed for a year.

“If you had a $100 million estate, you got a $100 million exemption,” Broach said.

Still, he said, the conversation surrounding the current exemption is significant as wealthier clients look to plan for the future.

Jennifer Sacheck, a partner with Dentons Bingham Greenebaum and a member of the firm’s Trusts, Estates and Wealth Preservation practice, said the estate tax exemption has been a hot topic over the past few years for high net worth clients.

Sacheck noted the state did away with its estate tax a decade ago.

According to the Indiana Department of Revenue, the Legislature repealed the Indiana Inheritance Tax in 2013.

Some pre-2013 estates continued to file original or amended returns. However, no inheritance tax returns for Indiana residents or nonresidents must be prepared or filed after Oct. 5, 2023.

“From a federal perspective, this has probably been the piece that’s had the biggest talk (from clients),” Sacheck said, adding that most of those clients are interested in learning more about the exemption first.

“We see a lot of generational wealth passing for a number of reasons, this being only one of those,” she said.

Most individual clients that contemplate making gifts under the exemption are retired, Sacheck said. Dentons is trying to do what she described as “preventative education” well in advance and urging clients to not come to the firm at the last minute before the exemption sunsets.

What happens in 2026?

It’s hard to predict what will happen to the exemption.

Shelley said Congress could do nothing and let it sunset, extend it, or enact a totally new law regarding federal estate tax exemptions. He said he thinks an extension is a real possibility, with new legislation unlikely.

Broach said the 2024 general election could also impact what happens to the exemption. He said there are some indicators that former President Donald Trump, in general, supports extending the exemption, given that it was enacted during his administration.

“But it’s all speculation. You just don’t know,” Broach said.

It can be hard to estate plan and be flexible when Congress keeps changing the laws and exemptions, Broach added.

Shelley said he thinks it’s unfair to not only the wealthier people, but also to average families, when there’s uncertainty about how to plan year to year and take advantage of exemptions that are allowed by law.

Sacheck said she thinks, for clients in a high net worth category, their focus regarding the estate tax exemption is starting to slowly shift as 2025 gets closer.

As far as the 2024 elections, Sacheck said clients’ general opinions seem to be that they should be prepared in advance in terms of what that might mean for the exemption.

“We do have two years before this sunsets,” she said. “A lot can happen in two years.”•

Please enable JavaScript to view this content.