Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowHeading into 2022, some Hoosier solo and small law firm attorneys were optimistic about the months ahead.

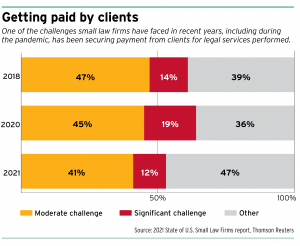

Of course, the COVID-19 pandemic didn’t leave the legal industry unscathed, with roughly half of all small firms reporting in Thomson Reuters’ 2021 State of U.S. Small Law Firms study that they endured a moderate or significant struggle in getting paid by clients over the last two years. Many also expressed concerns about acquiring new business.

But those firms that created a concentrated approach to addressing their payment challenges saw quick, positive results. By the same token, smaller firms were also afforded an opportunity to establish stronger roots and practice methods to bring in and retain clients.

While some Indiana solo and small firms didn’t have to worry about not getting paid, they still said improvements to their billing and administrative practices have already proved beneficial both to them and their clients.

Getting paid by clients posed at least a moderate challenge for 45% of respondents and a significant challenge for 19%, in 2020, according to Thomson Reuters’ 2020 State of U.S. Small Law Firms report. Meanwhile, 43% reported that not only did they have a plan to address the problem, they’d already implemented changes to address the issue.

About 76% in the 2020 report also said they experienced at least a moderate challenge in acquiring new client business, but only 29% reported having implemented changes to address that issue.

The situation was slightly better in 2021, when 41% reported that getting paid was a moderate challenge and 12% said it was a significant challenge. As for acquiring new clients, 75% said that issued posed a moderate or significant challenge.

Some of the most common responses to these challenges were increasing and monitoring billing rates, increasing retainers, improving or increasing payment collection, and accepting debit or credit cards as well as ACH payments.

These changes were largely made in an effort to either improve transparency and accountability for billing or to make the firm easier to do business with, thus increasing the likelihood of receiving payment.

While some Indiana firms did not experience payment struggles, they did notice a positive impact from their newly updated billing and office practices implemented both before and during the pandemic.

Implementing a credit card autopay contract system for the majority of her clients was one of primary reasons Zionsville solo attorney Donna Bays said her law firm didn’t encounter issues with receiving payment from clients during the pandemic.

“At the time when we are retained, they sign an advance authorization so we can charge their credit cards each month 10 days after invoice,” Bays explained. “LawPay helped us generate the forms for that. It’s probably the most effective business practice we’ve implemented in recent years.”

Bays’ family law firm began experimenting with the credit card autopay system in 2018. At the time, she thought, “If I have to pay all my utilities by autopay, why can’t my clients do the same?”

“And it worked,” she said. In fact, Bays said her clients feel more comfortable using the automatic online payments than they do writing a check.

“They just know it’s coming. And frankly, that makes their bank become their creditor instead of me,” she said.

Evansville attorneys Bradley J. Salmon and Charles S. Hewins, two former solo practitioners who combined firms at the start of 2022, said unmet payments have not been a concern with their clients, either.

“A big reason for our merger is our client retention, client relations, billing practices and general philosophies were already well-aligned,” Hewins said. “For our billable/flat-fee clients, we actually have not seen an uptick in unpaid accounts in the last two to three years.”

Hewins, who said there will most likely always be a small number of delinquent accounts, said their firm’s contingency fee clients have similarly not struggled to pay.

Hewins, who said there will most likely always be a small number of delinquent accounts, said their firm’s contingency fee clients have similarly not struggled to pay.

“During the pandemic, our primary concern hasn’t been getting paid by signed clients,” he said. “Rather, we were worried about whether the steady stream of new clients seeking services would dry up.”

Scquiring and retaining new client business remained a moderate concern for 50% of respondents in the past two years. That same concern was present for Hewins’ firm, but he said that while there was a small reduction in client demand, their overall retention percentage from new client inquiries increased. Why?

“Because we focused on accessibility,” Hewins said.

Homing in on accessibility included creating an easier experience for clients through alternative meeting methods such as Zoom, as well as before and after-hours appointments.

“We used the ‘free time’ the pandemic granted to us to teach ourselves how to improve the client experience,” Hewins said. “As a result of that focus, now that things are returning to normal, business has been booming.”

Indianapolis attorney Yasmin Stump of Yasmin L. Stump Law Group P.C. said her small firm was fortunate not to be strapped by payment concerns during the pandemic, mainly because the clients they represent include governmental entities and Fortune 500 companies.

“We have, for the most part, longstanding relationships with our clients, many of them,” Stump said.

“We have, for the most part, longstanding relationships with our clients, many of them,” Stump said.

Like Hewins and Bays, Stump said her firm implemented changes during the pandemic as an opportunity to do business in a new way.

“We actually did some office expansion during COVID-19,” she said. “We actually created a media room that would be set up all the time for virtual conferences, which we found have been very, very cost effective and efficient, both for our clients and for us, as well.”

Proactive approach

For solo and small firms that saw either payment problems or opportunities to grow their business offerings, one common theme remained: They made an intentional effort to improve and saw positive results.

Hewins said the pandemic has helped his law firm learn that offering clients unique ways to address legal needs is a good business decision.

Stump said if a solo or small firm puts their mind to it, they too could experience the same positive transformation.

“I think that, although sometimes it’s painful to go through the process of implementing a new plan, and there are people that are going to resist it, because you know, that it’s not the way they’ve done things before,” Stump said, “a plan and management that on all levels reduces inefficiencies can render very positive improvements for management and the firm administration.”•

Please enable JavaScript to view this content.